Personal Tax Relief Malaysia 2019 Lhdn

Loanstreet my 9 things to know when doing 2019 income tax e filing.

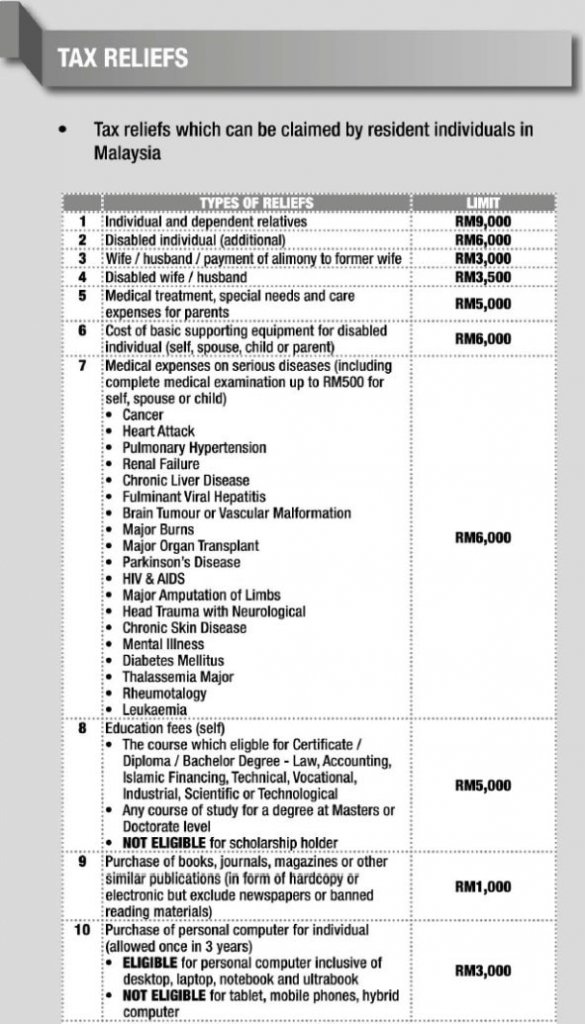

Personal tax relief malaysia 2019 lhdn. 3000 limited basic supporting equipment for disabled self spouse child or parent. Yes you ve come to the right place tax relief for your income taxes. Only services rendered in malaysia are liable to tax.

Malaysia income tax e filing guide. Tax relief year 2019. If you re a law abiding citizen and in the midst of filing your lhdn taxes for 2019 s assessment this guide is more important than ever.

Here are the income tax rates for personal income tax in malaysia for ya 2019. Personal tax relief malaysia 2020. 5 000 limited 3.

According to lhdn foreigners employed in malaysia must give notice of their chargeability to the non resident branch or nearest lhdn branch within 2 months of their arrival in malaysia. Below is the list of tax relief items for resident individual for the assessment year 2019. Medical expenses for parents.

Headquarters of inland revenue board of malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor. Understanding tax rates and chargeable income. The relief amount you file will be deducted from your income thus reducing your taxable income make sure you keep all the receipts for the payments.

Amount rm 1. Amending the income tax return form. How to pay income.

Ringgitplus how to maximize income tax refund 2019. Tax rebate for self if your chargeable income after tax reliefs and deductions does not exceed rm35 000 you will be granted a rebate of rm400 from your tax charged. What is income tax return.

Imoney income tax relief for ya 2018. Enquiry of tax position. Tax rates for year of assessment 2019 tax filed in 2020 chapter 6.

This relief is applicable for year assessment 2013 and 2015 only. Tax relief for year of assessment 2019 tax filed in 2020 chapter 5. Lembaga hasil dalam negeri tax relief history.

Self and dependent special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually. Comparehero 7 tax exemptions in malaysia to know about. Ringgitplus malaysia personal income tax guide 2020.

What is tax rebate. 6 000 limited disabled individual. W e f 28 december 2018 services liable to tax refers to any advice assistance or services rendered in malaysia and is not only limited to services which are of technical or management in nature.

Medical expenses for parents. 2019 27 411 904. Parent limited 1 500 for only one mother limited 1 500 for only one father.

Amount rm self and dependent. When you re completing your tax returns you are entitled to claim deductions for a number of expenses.